Crypto User Loses $9,000 in Seconds After Clicking Instagram Ad Promising Easy Profits

A disturbing incident recently highlighted the ever-present danger of sophisticated financial scams in the cryptocurrency space. An individual, identified as Jack and a Solana enthusiast utilizing the Phantom wallet, lost $9,000 in a matter of seconds after falling victim to a crypto drainer scheme. This swift financial devastation underscores the urgent need for heightened vigilance and robust security practices among all cryptocurrency users.

The Anatomy of a Crypto Drainer Scam

Jack’s ordeal began with an enticing Instagram advertisement. This ad, promising “easy profits,” served as the initial lure, redirecting him to a fraudulent website. Such deceptive advertising campaigns leverage social media platforms to target unsuspecting individuals, often promising unrealistic returns or exclusive opportunities within the crypto market. Once on the fake site, Jack encountered a manipulative prompt designed to extract sensitive information or trick him into granting malicious permissions.

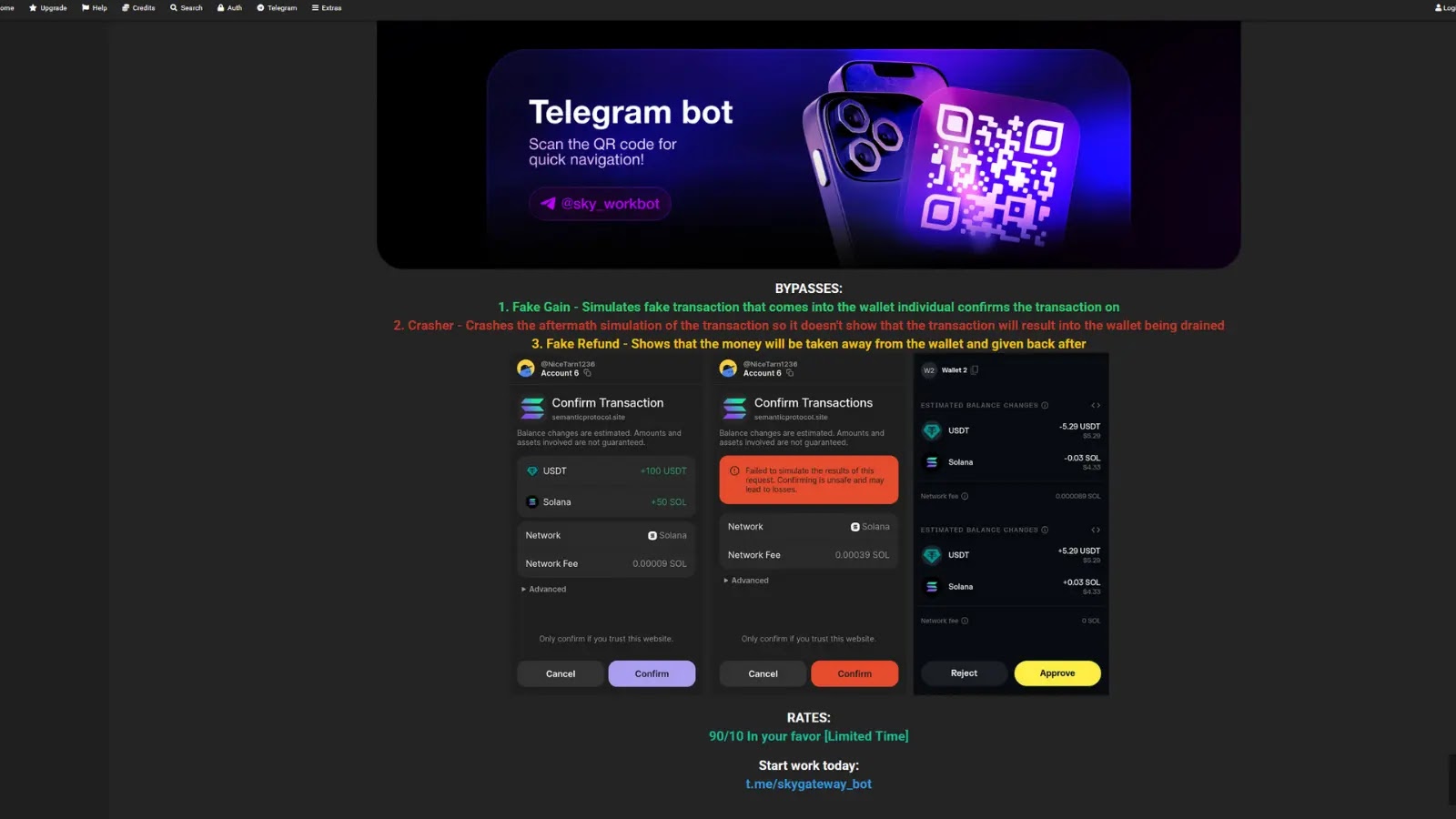

Crypto drainers are a particularly insidious form of malware or phishing attack. They operate by deceptively obtaining authorization from a victim to access their cryptocurrency wallet. This authorization is often sought under the guise of an update, a transaction confirmation, or a necessary security step. Once granted, the drainer automatically transfers all accessible funds from the victim’s wallet to a scammer-controlled address, often in near real-time, making recovery extremely difficult if not impossible.

Social Engineering and Deception Tactics

The success of this particular scam, like many others, hinges on advanced social engineering tactics. These tactics involve psychological manipulation to trick users into divulging confidential information or performing actions against their best interests. The “easy profits” narrative in the Instagram ad is a classic example of preying on a user’s desire for financial gain. The fraudulent website likely mimicked legitimate platforms, employing convincing visuals and urgent calls to action to create a sense of legitimacy and pressure.

- Phishing Websites: Scammers meticulously craft fake websites that are nearly identical to legitimate cryptocurrency exchanges or wallet providers. Minor discrepancies in the URL or security indicators often go unnoticed by unsuspecting users.

- Impersonation: Threat actors frequently impersonate official entities, often sending emails, messages, or placing ads that appear to be from trusted sources.

- Urgency and Fear: Scammers often create a sense of urgency, claiming limited-time offers or imminent security threats, to pressure victims into making hasty decisions without proper scrutiny.

Remediation Actions for Cryptocurrency Users

Protecting digital assets requires continuous vigilance and adherence to best practices. Users must adopt a proactive approach to security.

- Verify Sources Rigorously: Always double-check the legitimacy of any advertisement, email, or website, especially those promising financial gains. Manually type URLs for known services rather than clicking links.

- Be Skeptical of Unrealistic Promises: If an offer sounds too good to be true, it almost certainly is. Legitimate investment opportunities rarely guarantee “easy profits” with no risk.

- Enable Multi-Factor Authentication (MFA): Implement MFA on all cryptocurrency wallets, exchanges, and related accounts.Hardware security keys, such as FIDO U2F devices, offer a superior layer of protection against phishing.

- Use Hardware Wallets: For significant crypto holdings, hardware wallets (e.g., Ledger, Trezor) provide superior security by keeping private keys offline and requiring physical confirmation for transactions.

- Review Transaction Permissions: Before confirming any transaction, carefully review the permissions being requested. Understand what access you are granting and to whom. If a transaction requests excessive permissions (e.g., blanket approval for future transactions), it’s a major red flag.

- Stay Informed: Regularly follow reputable cybersecurity news sources (like Cybersecurity News) and official communications from your wallet providers and exchanges to stay updated on emerging threats.

- Beware of CVE-2023-38831 (WinRAR Vulnerability): Although not directly related to this Instagram scam, it’s a reminder that broader software vulnerabilities can be exploited to deliver malware, including crypto drainers. Ensure all software, especially operating systems and browsers, are kept updated to patch known vulnerabilities.

Tools for Enhanced Cryptocurrency Security

Leveraging appropriate tools can significantly bolster your defense against crypto drainers and other financial scams.

| Tool Name | Purpose | Link |

|---|---|---|

| Hardware Wallets (e.g., Ledger, Trezor) | Offline storage of private keys, physical transaction confirmation. | https://www.ledger.com / https://trezor.io |

| Phishing Protection Browser Extensions | Identify and warn against known phishing sites. | https://metamask.io/snaps/phishing-detection (Example for MetaMask) |

| Antivirus Software with Web Protection | Detect and block access to malicious websites and downloads. | https://www.bitdefender.com / https://www.kaspersky.com |

| Password Managers | Generate and store strong, unique passwords for all accounts. | https://lastpass.com / https://1password.com |

Conclusion

The incident involving Jack’s $9,000 loss serves as a stark reminder of the persistent and evolving threat landscape in decentralized finance. Crypto drainer scams, often facilitated by sophisticated social engineering through platforms like Instagram, highlight the critical need for continuous education and rigorous security practices among cryptocurrency users. Adopting a skeptical mindset towards unsolicited offers, diligently verifying sources, and implementing robust security measures are paramount to safeguarding digital assets in this high-stakes environment.