Cyber Insurance: What It Covers and What It Doesn’t

What it Cyber Insurance Policies Doesn’t Covers: Coverage and Cyber Liability

In an era where digital threats loom large, securing your business against cyber risks is not merely an option, but a necessity. Cyber insurance policies have emerged as a critical tool in managing these risks, providing financial protection and support in the event of a cyber incident. Understanding the intricacies of cyber insurance coverage and cyber liability is paramount for any organization seeking to safeguard its assets and reputation.

Understanding Cyber Insurance

What is Cyber Insurance?

Cyber insurance is a specialized type of insurance designed to protect businesses from the financial losses resulting from cyber events such as data breaches, cyber attacks, and other cyber incidents. Unlike general liability or commercial property insurance, cyber insurance specifically addresses the unique risks associated with digital assets and online operations. Cyber insurance policies can cover the cost of data recovery, legal fees, notification expenses, and even business interruption losses, but understanding the exclusions is vital since cyber insurance doesn’t cover all scenarios. Cyber insurance provides a safety net, ensuring that companies can recover and continue operations after a cyber event, but it’s crucial to understand that cyber insurance isn’t a complete solution on its own. Understanding what cyber insurance covers is crucial for protecting your business.

Importance of Cyber Liability Insurance

The importance of cyber liability insurance cannot be overstated in today’s digital landscape. As cyber threats become more sophisticated and frequent, the potential for financial loss and reputational damage increases exponentially, highlighting the need for adequate insurance products. Cyber liability insurance can help businesses mitigate these risks by providing coverage for expenses related to data breaches, legal settlements, and regulatory fines. Moreover, cyber liability insurance policies often include access to incident response services, such as forensic investigations and crisis management, which can be invaluable in the aftermath of a cyber attack. Having the right cyber insurance is crucial for safeguarding your business against these ever-evolving threats. Cyber insurance coverage helps you recover from an incident by providing the financial help to cover the cost of recovering data or paying fines.

Key Components of Cyber Insurance Policies

Cyber insurance policies typically include both first-party coverage and third-party coverage to address a range of potential losses. First-party cyber insurance covers expenses incurred directly by the insured party, such as data recovery, business interruption, and cyber extortion, but it’s important to remember that cyber insurance doesn’t cover third-party liability. Third-party cyber insurance, on the other hand, protects against liability claims made by others, such as customers or business partners, who have been affected by a cyber incident. Additionally, cyber policies may include coverage for regulatory fines, legal fees, and public relations expenses. Understanding these key components is essential for selecting a cyber insurance policy that provides adequate protection for your specific needs. The terms of cyber security insurance are complex and it is important to have a good understanding of the coverage limits.

Types of Cyber Insurance Coverage

First-party Coverage Explained

First-party cyber coverage within cyber insurance policies is designed to protect a business from direct losses it incurs as a result of a cyber incident. This type of coverage addresses expenses like data recovery, where the insurance provider helps to cover the cost of restoring compromised data after a cyber attack. Business interruption losses are also often covered, compensating the business for lost income if operations are disrupted due to a cyber event, yet it’s wise to review what cyber insurance doesn’t cover. Cyber extortion is another significant area, where cyber insurance assists with negotiation and ransom payments, mitigating financial loss associated with ransomware attacks. Understanding the nuances of first-party cyber insurance is crucial for businesses seeking comprehensive cybersecurity insurance protection.

Third-party Coverage and Its Benefits

Third-party coverage in cyber liability insurance offers protection when a business is held liable for damages to others resulting from a cyber incident. This might involve liability coverage for data breaches that expose customer information, leading to legal claims and settlements. Third-party cyber insurance can also cover the cost of defending against such claims, including legal fees and potential judgments. If a business partner suffers financial loss due to a cyber attack originating from your systems, third-party cyber coverage can provide essential protection. Understanding the scope and benefits of third-party coverage is essential for mitigating potential liability and safeguarding your business against external claims. Cyber liability insurance helps to cover the cost of any legal representation and fines.

Specific Types of Cyber Insurance

Here’s how specialized cybersecurity insurance policies address specific cyber risk scenarios:

- Data breach insurance covers expenses like notification costs, credit monitoring, and public relations, making it an essential component of a comprehensive business insurance strategy.

- Cyber extortion insurance helps with ransomware attacks, covering negotiation and ransom payments, as well as incident response expertise.

This reflects the diverse range of cyber risks businesses face today, necessitating tailored insurance products to address specific vulnerabilities.

Assessing Your Need for Cyber Insurance

Why You Need Cyber Insurance

Assessing your need for cyber insurance begins with recognizing the pervasive nature of cyber threats in today’s digital landscape. The question isn’t if a cyber incident will occur, but when. Even small businesses are increasingly vulnerable to sophisticated cyber attacks, making cyber insurance a crucial layer of protection, as insurance isn’t always sufficient without proper risk management. General liability or commercial property insurance policies typically do not cover cyber risks, underscoring the necessity of a dedicated cybersecurity insurance policy. Understanding your specific cyber risk profile and potential financial exposure is the first step in determining whether you need cyber insurance. We at Teamwin Global Technologica recognize that cyber coverage is important for your peace of mind, in case you need to make insurance claims to cover the cost of fines or data recovery.

Determining How Much Cyber Insurance You Need

Determining the appropriate amount of cyber insurance requires a comprehensive evaluation of your business’s assets, operations, and potential liabilities. Start by assessing the value of your data, including customer information, intellectual property, and financial records. Consider the potential cost of a data breach, including notification expenses, legal fees, and regulatory fines. Evaluate your business’s reliance on technology and the potential impact of business interruption resulting from a cyber attack. A thorough risk assessment will help you determine the coverage limits you need to adequately protect your business, ensuring that you are not left exposed due to omissions insurance. We at Teamwin Global Technologica suggest that you always have the right cyber insurance to keep your business safe from any kind of cyber risk.

Evaluating Cyber Risk in Your Business

Evaluating cyber risk in your business involves a detailed analysis of your IT infrastructure, security protocols, and employee training, which is essential for understanding your business insurance needs. Conduct a thorough assessment of your network vulnerabilities, including outdated software, weak passwords, and unpatched systems. Review your data security policies and procedures to ensure they comply with industry best practices and regulatory requirements. Assess employee awareness of cyber threats and provide regular training on phishing scams, malware, and other common attack vectors. By understanding your specific cyber vulnerabilities, you can better assess the level of cyber insurance coverage you need. Teamwin Global Technologica recognizes the importance of proactive cybersecurity measures, and we recommend combining cyber insurance with robust security practices. With Teamwin, you can rest assured your data is protected and covered by cyber security insurance, in case a cyber event occurs.

Cyber Insurance Costs and Policies

How Much Does Cyber Insurance Cost?

Understanding cyber insurance costs is crucial for businesses budgeting for cybersecurity. The insurance cost can vary significantly based on several factors, including the size of the company, the industry, and the level of coverage required. Smaller businesses might find cyber insurance coverage starting at a few thousand dollars per year, while larger enterprises could face premiums in the tens of thousands or even higher. It’s important to obtain quotes from multiple insurance companies to compare coverage options and pricing for various insurance products available in the market. Teamwin Global Technologica helps its clients understand these nuances, ensuring they secure the right cyber insurance to suit their needs and budget.

Factors Affecting Cyber Insurance Premiums

Several factors influence cyber insurance premiums. A company’s cybersecurity posture, including its security controls, employee training programs, and incident response plan, plays a significant role. Businesses with robust security measures may qualify for lower premiums, which can help offset the costs of comprehensive business insurance. The type and amount of data a company handles also affect costs; organizations processing sensitive information, such as healthcare data or financial records, often face higher rates. The company’s revenue and industry are also considered. Teamwin Global Technologica helps businesses assess and improve their cybersecurity posture to potentially reduce cyber insurance costs and improve cyber coverage options.

Finding the Right Cyber Insurance Policy

Finding the right cyber insurance policy involves carefully assessing your business’s specific needs and risks. Start by evaluating your existing cybersecurity measures and identifying potential gaps. Determine the types of cyber events your business is most vulnerable to, such as data breaches, ransomware attacks, or phishing scams. Compare cyber insurance coverage options from various insurance providers, focusing on policy limits, exclusions, and deductibles. Look for a policy that provides comprehensive coverage for both first-party and third-party losses. Teamwin Global Technologica can guide you through this process, helping you select a cyber insurance policy that adequately protects your business.

Claims and Coverage in Cyber Insurance

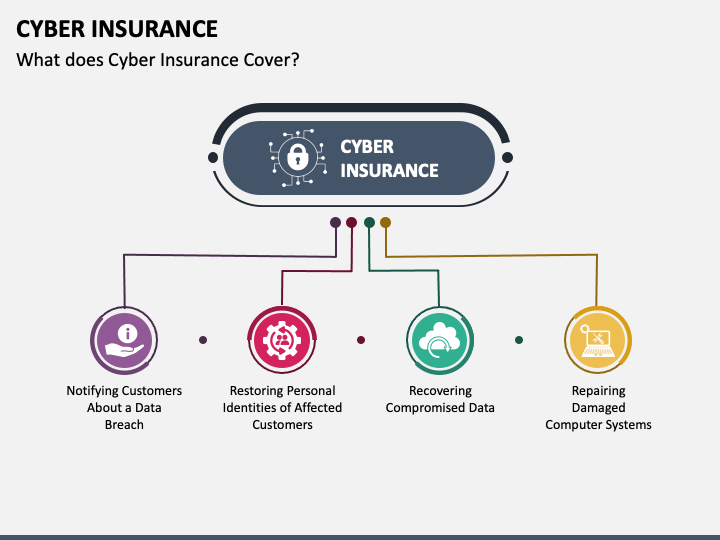

What Cyber Insurance Covers

Cyber insurance coverage is designed to protect businesses from a wide range of financial losses resulting from cyber incidents. Typically, cyber policies cover the cost of data breach investigations, legal fees, and notification expenses for affected individuals, but it’s important to be aware of the cost of notifying those impacted. Cyber insurance coverage can also extend to business interruption losses if a cyber attack disrupts operations. Furthermore, cyber extortion insurance can provide assistance with ransom payments and negotiation in the event of a ransomware attack. It is important to have the right cyber insurance, with the appropriate cyber coverage, as general liability and commercial property insurance often do not cover these digital-specific risks. Teamwin Global Technologica stresses the importance of understanding what your cyber insurance policy covers, as many businesses are unaware of what cyber insurance doesn’t cover.

Common Exclusions in Cyber Insurance Policies

Understanding the common exclusions in cyber insurance policies is essential to avoid unexpected gaps in coverage. Many cyber insurance policies don’t cover losses resulting from pre-existing vulnerabilities or known security flaws. Intentional acts by employees or insiders may also be excluded. War, terrorism, and other acts of state are typically not covered. Furthermore, some cyber insurance policies don’t cover losses resulting from inadequate security measures or failure to implement recommended security controls. Teamwin Global Technologica advises businesses to carefully review the exclusions in their cyber insurance policy to ensure they have adequate protection against potential cyber risks. It’s important to understand what your insurance covers and doesn’t cover.

Steps to Take After a Cyber Incident

Taking swift and decisive action after a cyber incident is crucial to minimizing financial loss and reputational damage. Immediately notify your insurance provider and engage a qualified incident response team to investigate the breach. Preserve all relevant data and documentation to support your insurance claims. Implement containment measures to prevent further damage and restore your systems and data. Notify affected individuals and regulatory authorities as required by law. Review and update your cybersecurity measures to prevent future incidents. Teamwin Global Technologica provides expert guidance and support throughout the incident response process, helping businesses navigate the complexities of cyber insurance claims and recovery.

5 Surprising Facts About Cyber Insurance: What It Covers and What It Doesn’t

- Many policies cover social engineering fraud, where attackers trick employees into transferring money or sensitive data.

- Cyber insurance often includes coverage for reputational damage, which can be crucial after a data breach.

- Some policies offer coverage for business interruption, helping companies recover lost income during downtime due to cyber incidents.

- Not all policies cover insider threats; damages caused by employees or contractors may be excluded.

- Cyber insurance may also provide access to expert resources, such as legal and IT professionals, to help manage a crisis.

What is cyber insurance and what does it cover?

Cyber insurance, also known as cybersecurity insurance, is designed to protect businesses from financial losses resulting from cyber incidents such as data breaches, cyber attacks, and other cyber threats. It typically covers various costs associated with these events, including legal fees, notification costs, and damage to reputation.

What types of cyber insurance policies are available?

There are several types of cyber insurance policies, including first-party cyber insurance, which covers direct losses to your business, and third-party cyber insurance, which provides coverage for claims made by customers or partners affected by a cyber incident. Additionally, policies can include data breach insurance, cyber extortion coverage, and technology errors and omissions insurance.

What does cyber liability insurance cover?

Cyber liability insurance covers costs related to data breaches, including expenses for notification, credit monitoring, legal fees, and public relations efforts to mitigate reputational damage. It may also cover claims from affected third parties and regulatory fines resulting from a cyber event.

What is not covered by cyber insurance?

Cyber insurance doesn’t cover all types of losses. For example, it typically excludes coverage for general liability claims unrelated to cyber incidents, intentional acts, and certain regulatory fines. It’s crucial to read the policy details to understand the specific exclusions.

How much does cyber insurance cost?

The cost of cyber insurance can vary widely based on factors such as the size of your business, the industry you operate in, and the level of coverage you require. On average, businesses can expect to pay a few thousand dollars annually, but this can increase for higher coverage limits or additional risks.

What should I consider when choosing the right cyber insurance policy?

When selecting the right cyber insurance policy, consider factors such as the coverage limits, types of coverage included, the insurer’s reputation, and the specific cyber risks your business faces. It’s essential to ensure that the policy aligns with your business needs and potential exposure to cyber incidents.

How can businesses benefit from cyber insurance?

Businesses can benefit from cyber insurance by gaining financial protection against losses due to cyber incidents, which can be costly. This insurance helps cover the costs of responding to a cyber event, including legal fees, notification costs, and potential settlements, allowing businesses to recover more quickly.

What are the insurance claims procedures for cyber incidents?

The insurance claims procedures for cyber incidents typically involve notifying your insurance provider as soon as a cyber event occurs. This may include providing details about the incident, collaborating with forensic experts, and submitting documentation of incurred costs. Understanding your insurer’s claims process can expedite your recovery.

What is the demand for cyber insurance in today’s market?

The demand for cyber insurance has significantly increased as businesses face rising cyber threats and incidents. Companies are recognizing the importance of protecting themselves against potential financial losses and reputational damage, leading to a growing market for cyber insurance products.