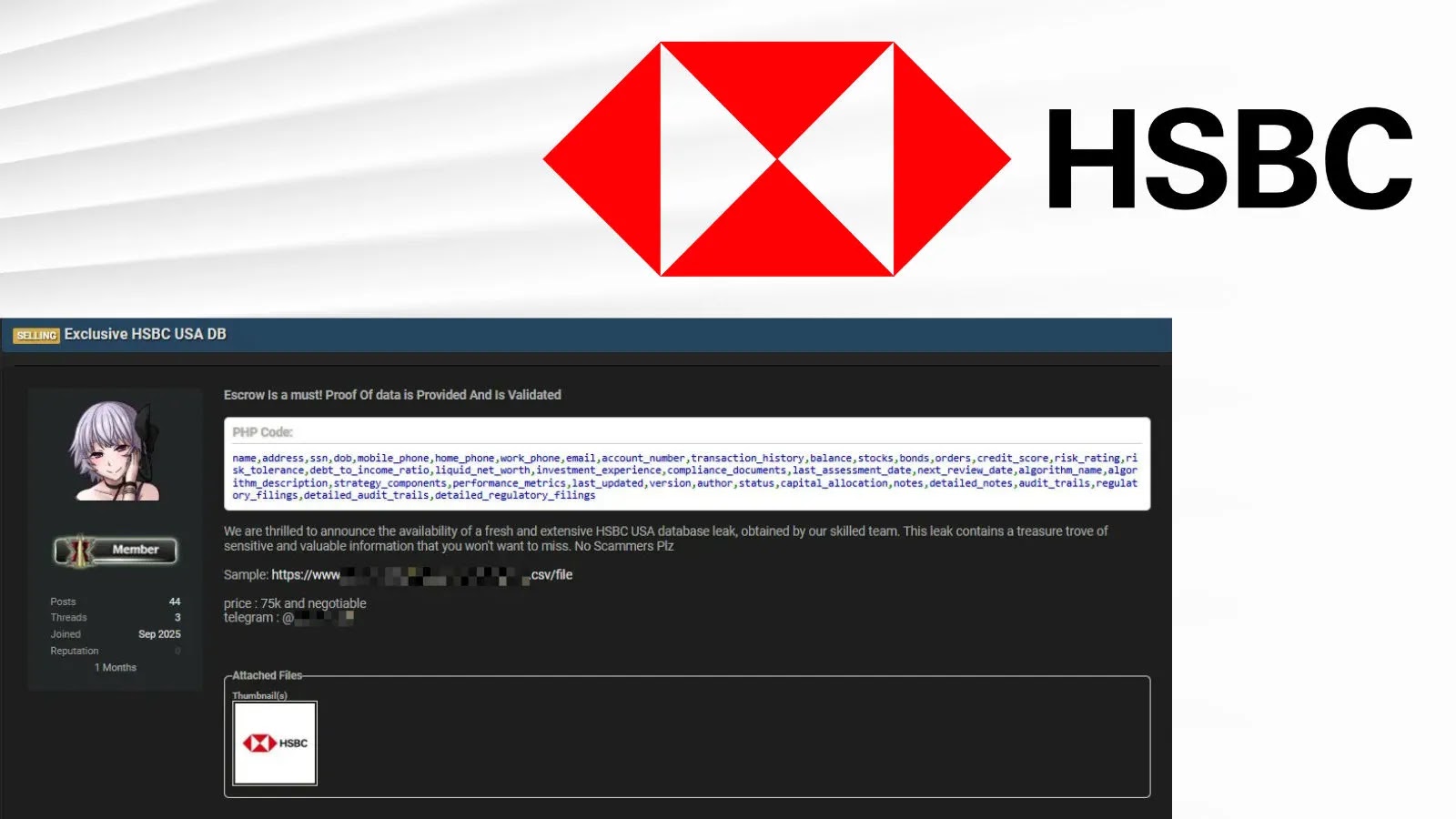

Hackers Allegedly Claims Breach Of HSBC USA Customers Records Including Financial Details

A disturbing report has emerged from the dark web, sending ripples of concern through the financial sector. A threat actor has publicly claimed responsibility for a significant breach targeting HSBC USA, alleging access to an extensive database containing sensitive Personal Identifiable Information (PII) and critical financial details belonging to HSBC customers. This alleged incident, first highlighted by Cybersecuritynews.com, underscores the persistent and evolving threat landscape facing major financial institutions.

The Alleged HSBC USA Breach: What We Know

The hacker, operating under a currently unverified alias, posted screenshots and samples of the purportedly stolen data on a prominent dark web leak forum. These samples are claimed to be evidence of a coordinated effort to penetrate HSBC’s systems and extract a vast quantity of customer records. While the full scope and authenticity of the data are still under investigation, the nature of the alleged information is deeply concerning. It reportedly includes, but is not limited to:

- Customer Names

- Contact Information (Addresses, Phone Numbers, Email IDs)

- Account Details

- Other sensitive financial data

Such a compromise could have severe repercussions for affected individuals, ranging from identity theft and fraud to targeted phishing attacks. For HSBC USA, if confirmed, it represents a significant blow to customer trust and a potential regulatory nightmare.

Understanding the Threat: PII and Financial Data Breaches

Breaches involving PII and financial details are among the most damaging cyber incidents. PII, by definition, is any data that could potentially identify a specific individual. When combined with financial details, it creates a potent weapon for malicious actors. The lifecycle of such stolen data typically involves:

- Initial Compromise: Perpetrators gain unauthorized access through various methods, such as phishing, exploiting vulnerabilities (it is crucial to note that no specific CVEs related to this alleged breach have been identified or publicly disclosed yet, as the breach is being investigated), or insider threats.

- Data Exfiltration: Sensitive data is covertly transferred out of the compromised system.

- Monetization: Stolen data is frequently sold on dark web marketplaces for use in financial fraud, identity theft, or ransomware campaigns.

The alleged breach against HSBC USA serves as a stark reminder that even institutions with robust security measures are constant targets of sophisticated cyber adversaries.

Remediation Actions for Financial Institutions

While HSBC USA investigates the claim, financial institutions universally must remain vigilant and proactive. Based on the nature of this alleged incident, here are critical remediation and preventative actions:

- Immediate Incident Response Activation: Conduct a thorough forensic investigation to confirm the breach, identify the attack vector, and determine the full extent of compromised data.

- Customer Notification: If a breach is confirmed, promptly and transparently notify affected customers in compliance with relevant data privacy regulations (e.g., GDPR, CCPA). Offer identity theft protection services where appropriate.

- Credential Hardening: Implement and enforce strong password policies, multi-factor authentication (MFA) across all systems, and regular password rotations.

- Vulnerability Management: Continuously monitor and patch known vulnerabilities. While no specific CVEs are tied to this alleged incident, a proactive vulnerability management program is paramount. For example, exploiting unpatched critical vulnerabilities like those often found in web applications (e.g., SQL Injection, Cross-Site Scripting, although no specific CVE can be cited for this alleged breach at this time) remains a common entry point.

- Enhanced Monitoring: Implement advanced threat detection systems for unusual network activity, data exfiltration attempts, and anomalous user behavior.

- Employee Training: Regularly train employees on cybersecurity best practices, including recognizing phishing attempts and social engineering tactics.

- Data Encryption: Ensure all sensitive data, both at rest and in transit, is encrypted using strong cryptographic algorithms.

- Access Control Review: Regularly review and enforce the principle of least privilege, ensuring employees only have access to the data necessary for their roles.

Security Tools for Proactive Defense

Effective defense against sophisticated attacks requires a layered approach using various security tools. Here are categories of tools beneficial for financial institutions:

| Tool Category | Purpose | Examples |

|---|---|---|

| Endpoint Detection & Response (EDR) | Monitor and respond to threats on endpoints (workstations, servers). | CrowdStrike Falcon, SentinelOne, Microsoft Defender for Endpoint |

| Security Information & Event Management (SIEM) | Centralized logging, monitoring, and analysis of security events. | Splunk Enterprise Security, IBM QRadar, Microsoft Azure Sentinel |

| Data Loss Prevention (DLP) | Prevent sensitive data from leaving the organization’s control. | Symantec DLP, Forcepoint DLP, McAfee DLP |

| Vulnerability Scanners | Identify and report security vulnerabilities in systems and applications. | Tenable Nessus, Qualys, Rapid7 InsightVM |

| Identity & Access Management (IAM) | Manage user identities and access privileges. | Okta, Duo Security, Ping Identity |

Conclusion: Heightened Vigilance Required

The alleged breach of HSBC USA serves as a sobering reminder of the constant and evolving threats faced by financial institutions globally. While the full details are still emerging, the claims highlight the critical importance of robust cybersecurity defenses, proactive threat intelligence, and a swift, decisive incident response capability. Organizations must continually adapt their security posture, invest in advanced tools, and foster a strong security culture to protect sensitive customer data from increasingly sophisticated adversaries.