Network Segmentation for Compliance (e.g., PCI-DSS)

PCI DSS Network Segmentation for Compliance: Achieving PCI DSS Compliance

In today’s digital landscape, ensuring the security of cardholder data is paramount for any organization that handles payment card information. Achieving and maintaining PCI DSS compliance is not just a regulatory requirement but a crucial step towards building trust with customers and protecting your business from costly data breaches. One of the most effective strategies for securing your cardholder data environment (CDE) and streamlining your compliance efforts is through the implementation of robust network segmentation divides.

Understanding PCI DSS Compliance

Achieving and maintaining compliance with PCI DSS is a complex but essential undertaking for businesses that process, store, or transmit cardholder data. Understanding the core principles and requirements of the PCI DSS standard is the first step towards building a secure and compliant environment. This involves a thorough assessment of your current infrastructure and processes to identify any gaps or vulnerabilities that could expose cardholder data to unauthorized access.

What is PCI DSS?

PCI DSS, or Payment Card Industry Data Security Standard, is a set of security standards designed to protect cardholder data and reduce fraud. The PCI Security Standards Council developed these standards to ensure consistent data security measures are implemented globally. The ultimate goal of PCI DSS is to protect cardholder data wherever it resides, whether it is being processed, stored, or transmitted. By adhering to these standards, businesses can minimize their risk of data breaches and maintain the trust of their customers.

Importance of PCI DSS Compliance

The importance of achieving PCI DSS compliance cannot be overstated. Compliance with PCI DSS is a necessity for organizations that handle cardholder data, emphasizing the importance of security and compliance. Failure to comply can result in significant financial penalties, legal repercussions, and damage to your brand reputation. More importantly, PCI DSS compliance significantly enhances network security and reduces the likelihood of data breaches, protecting sensitive cardholder information and ensuring the continuity of your business operations. The implementation of PCI DSS controls demonstrates a commitment to safeguarding customer data, building trust, and maintaining a competitive edge in the marketplace through effective security and compliance.

Overview of PCI DSS v4.0

PCI DSS v4.0 represents the latest evolution of the Payment Card Industry Data Security Standard, designed to address emerging threats and evolving payment technologies. This updated version introduces several key changes and enhancements aimed at strengthening security controls and improving the overall compliance process. Organizations must familiarize themselves with the new requirements and adapt their security strategies accordingly to maintain PCI compliance and effectively protect [the] cardholder data environment.

Network Segmentation for PCI DSS Compliance

What is Network Segmentation?

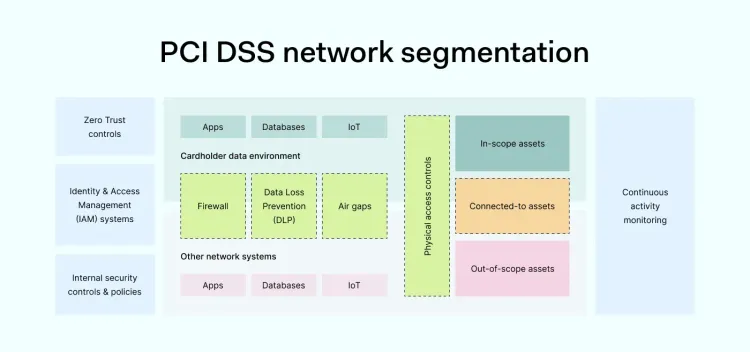

Network segmentation for PCI DSS compliance is a critical security technique that involves dividing a network into smaller, isolated network segments to reduce the scope of PCI DSS compliance. It aims to isolate systems that store, process, or transmit cardholder data from those that do not, thereby minimizing the impact of a potential breach through effective segmentation efforts. By creating these isolated segments, organizations can limit the scope of their PCI DSS assessment, focusing their efforts and resources on protecting the most sensitive areas of their network infrastructure. Effective segmentation requires careful planning, configuration, and ongoing monitoring to ensure its continued effectiveness in securing cardholder data.

Benefits of Network Segmentation for PCI DSS

The benefits of network segmentation for PCI DSS are substantial, most notably in reducing the scope of compliance. By isolating the cardholder data environment (CDE) from the entire network using network segmentation, organizations can significantly reduce the cost and effort associated with PCI DSS compliance. Network segmentation helps to minimize the number of systems that fall within the PCI scope, streamlining the assessment process and reducing the complexity of security controls. Furthermore, implementing network segmentation enhances network security by limiting the potential impact of a breach, preventing attackers from gaining access to [the] sensitive cardholder data environment beyond the initially compromised network segment. Proper segmentation ensures that only the necessary network traffic is allowed to flow between segments, enhancing security.

Implementing Network Segmentation

To implement network segmentation effectively, organizations must first identify all systems and network segments that store, process, or transmit cardholder data. Once identified, segmentation strategies can be employed to isolate these systems from the rest of the network. This can be achieved through various means, such as firewalls, virtual LANs (VLANs), and access control lists (ACLs) that ensure that segmentation is effective. Furthermore, organizations should establish clear segmentation policies and procedures to govern network access and ensure that only authorized personnel and systems can access the cardholder data environment. Regular monitoring and testing of segmentation controls are essential to verify their effectiveness and maintain ongoing PCI DSS compliance.

Scope of PCI DSS Compliance

Defining the Scope of Compliance

The scope of PCI DSS compliance is a critical element in understanding and achieving compliance scope for PCI DSS. Defining the scope of compliance involves identifying all systems, network segments, and processes that store, process, or transmit cardholder data, as well as any systems that are connected to them. This definition directly influences the extent of the PCI DSS assessment and the implementation of network security controls within the organization’s network. Accurately defining the scope is essential for efficient and cost-effective PCI compliance. By clearly delineating the systems that fall within the PCI DSS scope, organizations can streamline their security efforts and focus resources where they are most needed to meet PCI DSS requirements.

Cardholder Data Environment and Its Scope

The cardholder data environment (CDE) is the core of PCI DSS compliance within the organization’s network architecture. Its scope encompasses all people, processes, and technologies that handle cardholder data. Understanding the boundaries of the CDE is paramount for effective PCI network segmentation for PCI DSS. Any system or network segment that has access to cardholder data is considered part of the CDE and must adhere to all relevant PCI DSS requirements. The scope of the CDE dictates the extent of security controls needed, including access control, encryption, and monitoring. By carefully defining and isolating the CDE, organizations can minimize the impact of potential breaches and streamline their PCI DSS assessment.

Reducing the Scope with Network Segmentation

Network segmentation is a powerful technique to reduce the scope of PCI DSS compliance and enhance network security. By dividing the entire network into smaller, isolated network segments, organizations can limit the exposure of cardholder data in their secure network. The goal of PCI DSS network segmentation is to isolate the CDE from other, less secure parts of the network, thereby reducing the number of systems subject to stringent PCI DSS controls. Effective segmentation allows organizations to focus their resources on protecting the most critical assets and simplifies the PCI DSS assessment process. By implementing robust network segmentation for PCI DSS, businesses can significantly improve their security posture and achieve PCI compliance more efficiently while optimizing network performance.

Best Practices for PCI DSS Network Segmentation

Network Security Best Practices

To achieve optimal network security within a PCI DSS compliant environment, adherence to network security best practices is paramount. One key area is implementing robust access control mechanisms, ensuring only authorized personnel have access to the sensitive cardholder data environment within the secure network. The principle of least privilege should be applied rigorously across the entire network infrastructure, limiting access to only what is necessary for each user’s role. Furthermore, regular vulnerability assessments and penetration testing should be conducted to identify and remediate potential weaknesses in the network security posture across the network. By following these best practices, organizations can significantly enhance network security and reduce the risk of data breaches, while optimizing segmentation efforts. network performance within the segmented network.

Security Controls for Effective Segmentation

Security controls are the cornerstone of effective segmentation for PCI DSS compliance. Firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS) play a vital role in monitoring and controlling network traffic between network segments. Implementing strong encryption protocols, such as TLS and SSL, is essential for protecting [the] cardholder data environment in transit and at rest. Furthermore, multi-factor authentication (MFA) should be enforced to enhance access control security and prevent unauthorized access to sensitive systems. Regular review and updating of security control configurations are necessary to adapt to evolving threats and maintain PCI DSS requirements, ensuring your segmented network remains resilient against potential attacks.

Monitoring and Maintaining Segmentation

Once network segmentation for PCI DSS is implemented, continuous monitoring and maintenance are critical for its ongoing effectiveness to meet compliance requirements. Organizations should establish robust monitoring systems to detect and respond to any unauthorized access attempts or suspicious network traffic patterns within their network architecture. Regular log analysis and security and compliance measures are crucial for effective monitoring. security information and event management (SIEM) solutions can help identify potential security incidents and ensure timely remediation. Periodic reviews of segmentation policies and configurations are also necessary to adapt to changes in the network environment and maintain PCI compliance. By proactively monitoring and maintaining segmentation, organizations can ensure the continued security of their cardholder data and the integrity of their network infrastructure.

Challenges and Solutions

Common Challenges in Achieving Compliance

Achieving PCI DSS compliance through network segmentation for PCI DSS can present several challenges for organizations. One common challenge is accurately defining the scope of compliance requirements, particularly in complex network environments. Identifying all systems that store, process, or transmit [the] cardholder data environment, as well as those connected to them, can be a daunting task. Another challenge is implementing segmentation strategies effectively, ensuring that network segments are properly isolated and that network traffic is controlled appropriately to create a secure network. Furthermore, maintaining ongoing compliance requires continuous monitoring, testing, and updating of security controls, which can be resource-intensive. Understanding and addressing these challenges is essential for successfully achieving PCI DSS compliance.

Solutions for Effective Network Segmentation

To overcome the challenges of implementing PCI network segmentation for PCI DSS, organizations can leverage a range of solutions. Utilizing advanced firewall technologies with granular access control capabilities can help enforce segmentation policies effectively. Virtualization and cloud computing technologies offer flexible options for creating isolated network segments. Implementing network access control (NAC) solutions can ensure that only authorized devices and users can access the cardholder data environment. Furthermore, engaging with qualified security consultants Compliance assessors can provide valuable expertise and guidance in designing and implementing effective segmentation strategies using network segmentation. By adopting these solutions, organizations can simplify the compliance process and enhance the network security of their cardholder data environment.

Future Trends in PCI DSS Compliance

The landscape of PCI DSS compliance is constantly evolving, driven by emerging threats and technological advancements. Future trends in PCI DSS compliance include a greater emphasis on automation, artificial intelligence (AI), and machine learning (ML) for security monitoring and threat detection. Cloud-based security solutions and services are also gaining traction, offering scalable and cost-effective options for securing cardholder data. Furthermore, the adoption of network segmentation best practices can enhance overall security. Zero-trust security is an essential approach in modern network segmentation efforts. Zero-trust security models, which assume that no user or device is inherently trusted, is expected to increase across the network. Organizations should stay informed about these future trends and adapt their security strategies accordingly to maintain PCI compliance and effectively protect cardholder data in the face of evolving threats while optimizing network performance.

5 Surprising Facts About Network Segmentation for Compliance (e.g. PCI-DSS)

- Network segmentation can significantly reduce the attack surface by isolating sensitive data, making it harder for attackers to access critical systems.

- Many organizations underestimate the cost savings associated with network segmentation, as it can lead to reduced compliance audit costs and lower insurance premiums.

- Implementing network segmentation can improve performance by reducing congestion on the network, allowing for more efficient resource allocation.

- Segmentation not only aids in compliance with regulations like PCI-DSS, but it can also enhance overall security posture by providing better visibility into network traffic.

- Despite its benefits, studies show that a significant number of organizations remain non-compliant with PCI-DSS due to inadequate segmentation practices.

What is PCI DSS and why is it important for network segmentation?

PCI DSS, or Payment Card Industry Data Security Standard, is a set of security standards designed to ensure that companies that accept, process, store or transmit credit card information maintain a secure environment. Network segmentation is crucial in achieving PCI DSS compliance as it helps in dividing the larger network into smaller, manageable segments, thereby reducing the scope of compliance and enhancing security controls.

How does network segmentation improve compliance with PCI DSS?

Network segmentation improves compliance with PCI DSS by reducing the attack surface. By implementing network segmentation, organizations can isolate cardholder data environments from other parts of the network, ensuring that only necessary systems are subject to PCI DSS requirements. This minimizes the risk of unauthorized access and simplifies the compliance process during PCI DSS audits.

What are the best practices for implementing network segmentation for PCI DSS?

Best practices for implementing network segmentation for PCI DSS include defining clear network segments for sensitive data, applying strict access controls, regularly reviewing network configurations, and monitoring traffic between different network segments. Additionally, organizations should ensure that segmentation controls remain effective and adapt to any network changes.

What is the difference between logical and physical segmentation in network security?

Logical segmentation involves dividing a network into different segments using software-based methods, such as VLANs, while physical segmentation physically separates network components using distinct hardware. Both methods can help in achieving PCI DSS compliance, but logical segmentation is often more flexible and easier to manage within a dynamic network environment using network segmentation best practices.

How does scoping and network segmentation relate to PCI DSS compliance?

Scoping and network segmentation are integral to PCI DSS compliance as they define which systems and network components fall under the PCI DSS requirements. By effectively segmenting the network, organizations can limit the scope of the compliance requirements to only those systems that handle cardholder data, thus simplifying the compliance process and reducing the effort needed for PCI DSS assessments.

What are the security benefits of PCI DSS network segmentation?

The security benefits of PCI DSS network segmentation include enhanced protection of sensitive information, reduced risk of data breaches, and improved network performance. By creating different network segments, organizations can better control access to sensitive areas of the network and prevent unauthorized users from moving laterally within the network.

Can network segmentation reduce the costs associated with PCI DSS compliance?

Yes, network segmentation can reduce the costs associated with PCI DSS compliance. By minimizing the scope of compliance, organizations can lower the number of systems and processes that need to be audited, which can lead to decreased audit costs and less resource allocation for ongoing compliance efforts.

How does implementing PCI DSS segmentation impact network performance?

Implementing PCI DSS segmentation can improve network performance by reducing congestion and enabling more efficient traffic management. By dividing the network into multiple segments, organizations can optimize data flow and reduce the load on any single part of the network, leading to better overall performance and user experience.